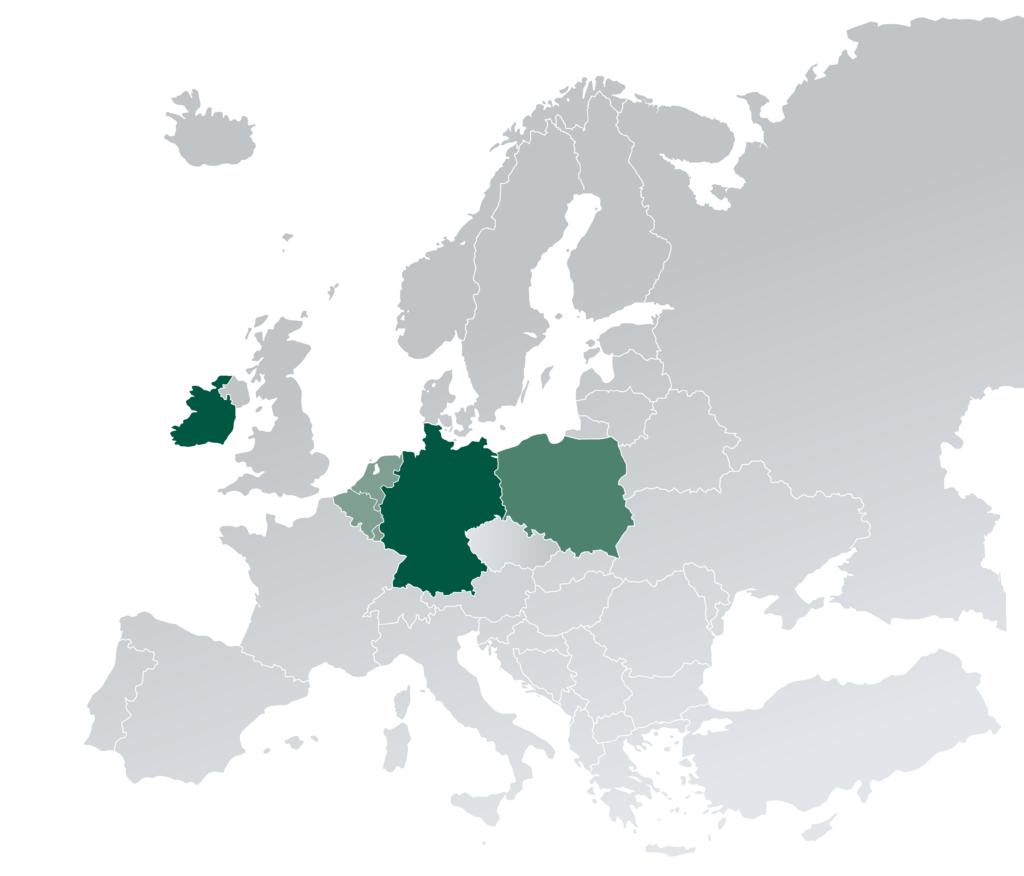

One-Stop-Shop for Real Estate Investments in Germany, Benelux and Central Eastern Europe (CEE).

OUR INVESTMENT APPROACH

In-House Strategy

- Core, Core+, Value Add, Opportunistic

- Customizable Funds, Mutual Funds and Separate Accounts

- Full life cycle management:

Transaction Management → Assets Management → Portfolio Management

Asset Management-Partner-Strategy

- Use of proven, local, specialised AM-Partners: Selection of “Best in Class”

- Asset classes subject to market and cycle opportunities

- Investment styles focus on Core to Opportunistic

OUR EXPERTISE

We serve a broad range of national and international institutional investors such as banks, insurance corporations, pension funds, endowments and family offices. We use our expertise combined with our entrepreneurial mentality to provide the quality and efficiency our investors and partners expect.

Our team provides exceptional local knowledge of real estate investing in Germany, Austria and CEE. We have insights into the local and regional real estate markets and can therefore identify investment opportunities and develop acquisition strategies. We take care of the due diligence process and ensure a smooth signing and closing process.

Our goal is to reduce risks for our investors and optimize assets to increase returns. We provide a transparent view of the existing real estate portfolio using data analytics tracking activity and monitoring performance. Our service offerings include the structuring and management of regulated and unregulated products.

We maximize the value appreciation potential of real estate investments through active asset management, taking into consideration particular types of properties and regional use cases. We focus on optimizing the performance of the assets through leasing, revitalizing and repositioning.

Co-shareholders Pegasus Capital Partners (Pegasus) and KAURI CAB are two of the “preferred partners” for development projects of KINGSTONE IM. The co-shareholders have their own architects, construction engineers and project developers who can handle the entire value chain in-house. They have many years of experience with established partners and a solid network of general contractors with whom it has worked for years in a spirit of trust.

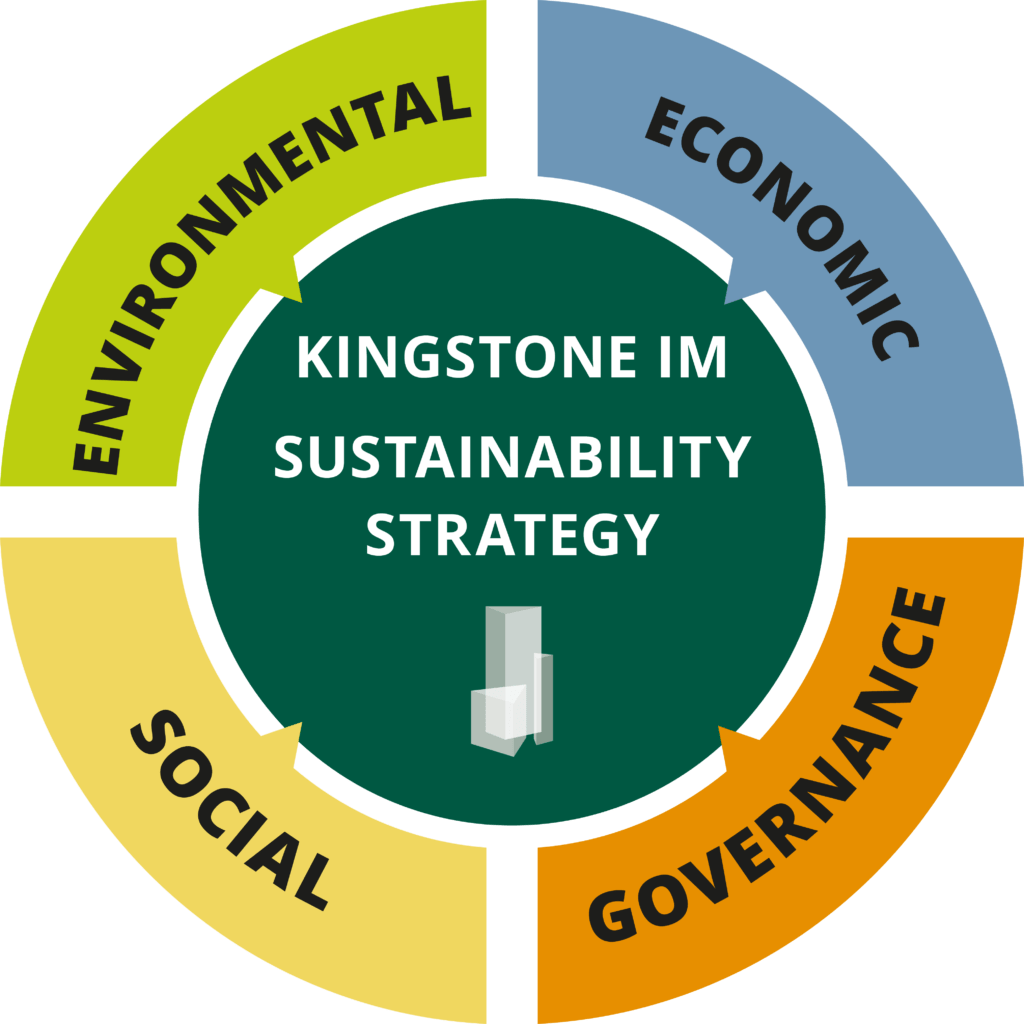

SUSTAINABILITY

INVESTMENT OPPORTUNITIES

Overview Open-Ended / Closed-Ended Special-AIF

KINGSTONE Wachstumsregionen Süddeutschland

Open-ended Special AIF

KINGSTONE Wachstumsregionen Süddeutschland II

Open-ended Special AIF

Separate Account of a German Bank Institution

Open-ended Special AIF

KINGSTONE Living &

Care I

Open-ended Special AIF

KINGSTONE Debt Opportunities FOCUS Mezzanine Germany I

Closed-ended Debt Special-AIF according to Luxembourg law S.A. SICAV-RAIF

KINGSTONE Wachstumsregionen Süddeutschland

Open-ended Special AIF

KINGSTONE Wachstumsregionen Süddeutschland II

Open-ended Special AIF

Separate Account of a German Bank Institution

Open-ended Special AIF

KINGSTONE Living &

Care I

Open-ended Special AIF

KINGSTONE Debt Opportunities FOCUS Mezzanine Germany I

Closed-ended Debt Special-AIF according to Luxembourg law S.A. SICAV-RAIF

Fund Vehicles & Separate Accounts

KINGSTONE IM offers institutional investors real estate investments in Germany, Austria and CEE as risk-adjusted and long-term oriented investment products. These investment products are structured as Alternative Investment Funds or Separate Accounts in Germany or Luxembourg.

We develop innovative investment products to achieve the objectives of our clients' real estate strategy. Each investment strategy is tailored according to the client's individual preferences, particularly in terms of types of use, geographic focus, target return and risk. With our expertise and extensive experience in managing individual properties and portfolios, we regularly exceed our investors' goals.

At the same time, we facilitate reliable deal sourcing through an excellent network in Germany and CEE.

Real Estate Debt

Our platform KINGSTONE Debt Advisory designs innovative in-house investment solutions with a focus on real estate debt. Investments are made in whole loan and mezzanine financing.

We offer a broad range of investment products and a holistic investment approach for institutional investors.

We offer a broad range of investment products and a holistic investment approach for institutional investors.

Pawel Sobolewski

Head of Fund Management

E: p.sobolewski@kingstone-re.com

Philipp Bach

Head of Transactions

E: p.bach@kingstone-re.com

Markus Mayer

Head of Client Capital Germany

E: m.mayer@kingstone-im.com

Sabine Bergmann

Managing Partner

E: p.muno@kingstone-re.com

Philipp Bach

Managing Partner

E: p.muno@kingstone-re.com